In a nutshell, SoFi is a wonderful option for individuals which have great economic health and fico scores of at least 690

Applying for that loan owing to SoFi try a fast and simple procedure that shall be become, and perhaps finished, completely on line. Most of the time, it takes your below five full minutes to receive a deal. You are going to begin by planning to SoFi’s site and you can filling in a short survey that may gather your own personal information as well due to loans Fort Payne the fact facts about your work background, debt records, or any other issue that will help SoFi decide how most of a threat lending money to you is generally.

Occasionally, SoFi also offers new individuals a discount or cheer to possess setting up a merchant account. Talking about never readily available and also the direct worth of the brand new brighten that is given may differ but it’s well worth prepared for 1 of them when you can as you possibly can change so you can extreme discounts sometimes.

Is actually Sofi Beneficial?

This will check extremely high in comparison with other loan providers however, there are numerous rewards you to definitely SoFi participants can enjoy for example job and you can monetary informing and you can a residential district out-of such as for instance-oriented people that are also planning to receive a higher level of monetary wellness.

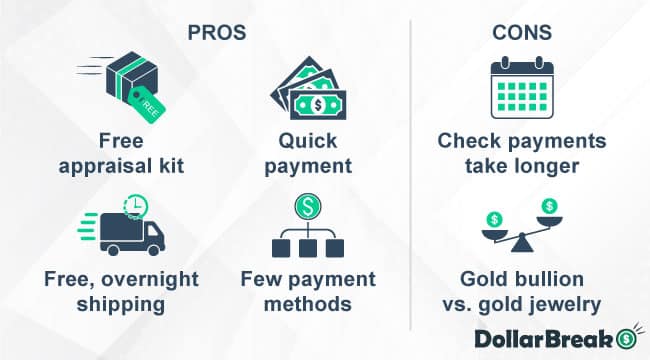

- Cost tend to be cheaper

- No origination payment otherwise prepayment penalty

- Zero later fee percentage

- Fund can’t be used in business costs

- App procedure would be slow

- Fund can take a bit to help you circulate

SoFi Signature loans Overview

Contained in this SoFi opinion, we’re going to look closer at a personal-demonstrated the form of finance company which is providing a revolutionary method of credit.

SoFi (brief to possess Societal Money) can be a bit away from a unique team in this try a low-lender bank. SoFi doesn’t bring one fund that you can use specifically to possess company aim. Within feedback, we are going to glance at the fixed-rate consumer loan given, that can be used to help you supplement individual costs you have such as settling credit debt, committing to a house update project, or and make any type of huge purchase for the individual means.

Searching for a corporate financing as an alternative? Glance at our Small company Loan Research chart to possess the ideal choices in terms of easy software techniques, customer care, prices, and.

SoFi deals from inside the payment fund. Put another way, youre considering the full mortgage upfront, therefore pay-off the eye and you will dominating towards the an appartment plan.

Than the their competitors, SoFi’s personal loans is significantly more flexible — the fresh borrowing number was larger, title lengths was expanded, the interest prices and you will charge try straight down, and you can SoFi is commonly happy to work-out a deferment otherwise a choice payment plan for many who run into issues purchasing. Indeed, SoFi advertises the newest friendliness of their unsecured loans to your the homepage: Zero origination charges. No pre-percentage costs. Zero late charges.

Although not, that it independency can come at a cost. Like most signature loans, you really must be financially steady, has actually a reasonable financial obligation-to-income proportion, and get a history of and also make money on time to help you meet the requirements.

In addition, SoFi’s financing aren’t fast. If you are most other loan providers try to topic fund immediately, SoFi takes its go out; just after acceptance, finance usually takes around thirty day period are disbursed, and possibly-a long time application produces the brand new hold off date actually prolonged.

That said, if you do be considered and you have committed and you may determination to make use of, SoFi are rich in financing.

Qualities Considering

SoFi also offers personal loans which can only be used for individual expenditures. They also offer a selection of other lending options as well as: